When it comes to building wealth, there isn’t just one way to invest. Different types of investments offer different levels of risk, reward, and accessibility, which is why many successful investors diversify across multiple assets. From stocks and bonds to real estate and even cryptocurrencies, each investment type plays a unique role in your financial journey. Understanding these options helps you decide which ones fit your goals, risk tolerance, and timeline.

New to investing? Check out How to Start Investing.

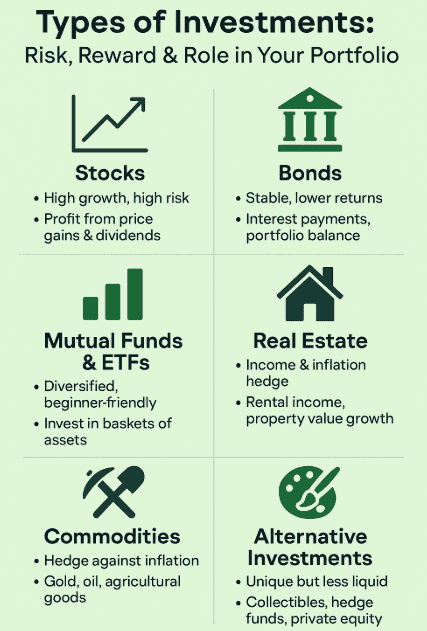

Stocks

Stocks represent ownership in a company. When you buy a stock, you own a small share of that business, which gives you the potential to profit as the company grows. Investors make money from stocks through capital gains (when the stock price rises) and dividends (profit-sharing payouts). While stocks can be volatile in the short term, they tend to deliver strong long-term growth, making them a cornerstone of most investment portfolios.

Bonds

Bonds are essentially loans you give to governments or corporations in exchange for interest payments. They are considered safer than stocks because they offer predictable returns, though the trade-off is generally lower growth potential. Bonds are often used to balance out riskier investments and provide stability in a portfolio, especially during market downturns.

Mutual Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) allow you to invest in a collection of assets, such as stocks, bonds, or both, in one purchase. This built-in diversification makes them attractive to beginners. Mutual funds are usually actively managed by professionals, while ETFs often track an index like the S&P 500. Both are cost-effective ways to invest broadly without having to pick individual assets yourself.

Real Estate

Real estate involves investing in property, either to rent out for steady income or to sell later at a higher value. While traditional real estate requires significant upfront capital and maintenance, there are also options like REITs (real estate investment trusts) that let you invest in property markets without direct ownership. Real estate is often considered a hedge against inflation and a source of passive income, though it can be less liquid than other investments.

Commodities

Commodities include physical goods like gold, silver, oil, and agricultural products. Investors often use them as a hedge against inflation or to diversify their portfolios. However, commodity prices can be highly volatile, influenced by supply-and-demand shifts, politics, and global events. While not always ideal for beginners, commodities can play a valuable role in reducing overall portfolio risk.

Cryptocurrencies

Cryptocurrencies such as Bitcoin and Ethereum have become popular alternatives in recent years. They offer high growth potential due to their decentralized and rapidly evolving nature. However, they are extremely volatile and carry significant risks, including regulatory uncertainty. For beginners, cryptocurrencies can be an exciting addition but should typically make up only a small portion of an investment portfolio.

Alternative Investments

Beyond traditional assets, there are alternative investments like collectibles (art, wine, rare coins), hedge funds, private equity, and peer-to-peer lending. These are usually less accessible to beginners and often require larger amounts of capital, but they can provide unique opportunities for diversification. They are generally considered higher risk and less liquid than mainstream investments.

How to Choose the Right Mix

The best investment strategy depends on your financial goals, risk tolerance, and time horizon. Younger investors with decades ahead may lean toward stocks and growth assets, while those nearing retirement often prefer bonds and income-generating investments. Diversification, spreading your money across multiple types of assets, is key to managing risk while still seeking growth. A balanced mix ensures you’re not overly exposed to one market.

Staying Informed and Adjusting Over Time

Investing isn’t a one-time decision; it’s an ongoing process. Markets change, your personal goals evolve, and your risk tolerance may shift over time. Regularly reviewing and adjusting your portfolio ensures that your investments continue to align with your needs. This doesn’t mean reacting to every market dip, but rather making thoughtful, long-term adjustments.

Summary

There are many types of investments to choose from, each with its own benefits and drawbacks. Stocks offer growth, bonds provide stability, funds deliver diversification, real estate creates income and security, and newer options like cryptocurrency offer potential but come with volatility. The right mix depends on your personal goals and comfort with risk. By learning the basics of each investment type and diversifying wisely, you can build a portfolio that balances safety with growth and sets you on the path toward long-term financial success.

FAQs

Do I need to invest in all types of assets?

No. Diversification is important, but that doesn’t mean you need every type of investment. A mix of stocks, bonds, and funds is enough for most beginners, with real estate or alternatives added later if it fits your goals.

How much of my portfolio should be in risky assets like stocks or crypto?

It depends on your risk tolerance and timeline. Younger investors often hold more stocks (70–90% of their portfolio) for growth, while crypto is usually best kept under 5–10% due to its volatility.

Can I start investing with little money?

Yes. Thanks to fractional shares and low-cost ETFs, you can begin with as little as $10–$50. The key is consistency, small, regular contributions compound into meaningful growth over time.

Be sure to check out What is Compound Interest and How does it work?.

What’s the safest type of investment?

U.S. Treasury bonds and government-backed securities are generally considered the safest, though they offer lower returns. For beginners, mixing them with stocks or funds helps balance risk.

How often should I rebalance my portfolio?

Many investors review their portfolio once or twice a year. Rebalancing ensures your asset mix stays aligned with your goals, especially if one type of investment grows faster than others.

Are alternative investments worth it for beginners?

Usually not. Alternatives like collectibles or private equity are less liquid and higher risk. Most beginners are better off starting with stocks, bonds, and funds before exploring alternatives.

How do taxes affect different investments?

Some accounts (like IRAs or 401(k)s) are tax-advantaged, making them ideal for retirement investing. In taxable accounts, dividends, interest, and capital gains may be taxed differently depending on the asset.