Retirement is a stage of life many people look forward to, but enjoying it comfortably requires careful planning. Without a budget, it’s easy to underestimate how much money you’ll actually need or to overspend in the early years, leaving less for later. A retirement budget helps you align your savings and income with your lifestyle, so you can cover essentials, prepare for rising healthcare costs, and still enjoy the freedom you’ve worked hard for. The sooner you start planning, the more confident and secure your retirement years will be.

New to budgeting? Start with What Is a Budget? Understanding Budgeting.

Why Retirement Budgeting Is Critical for Financial Security

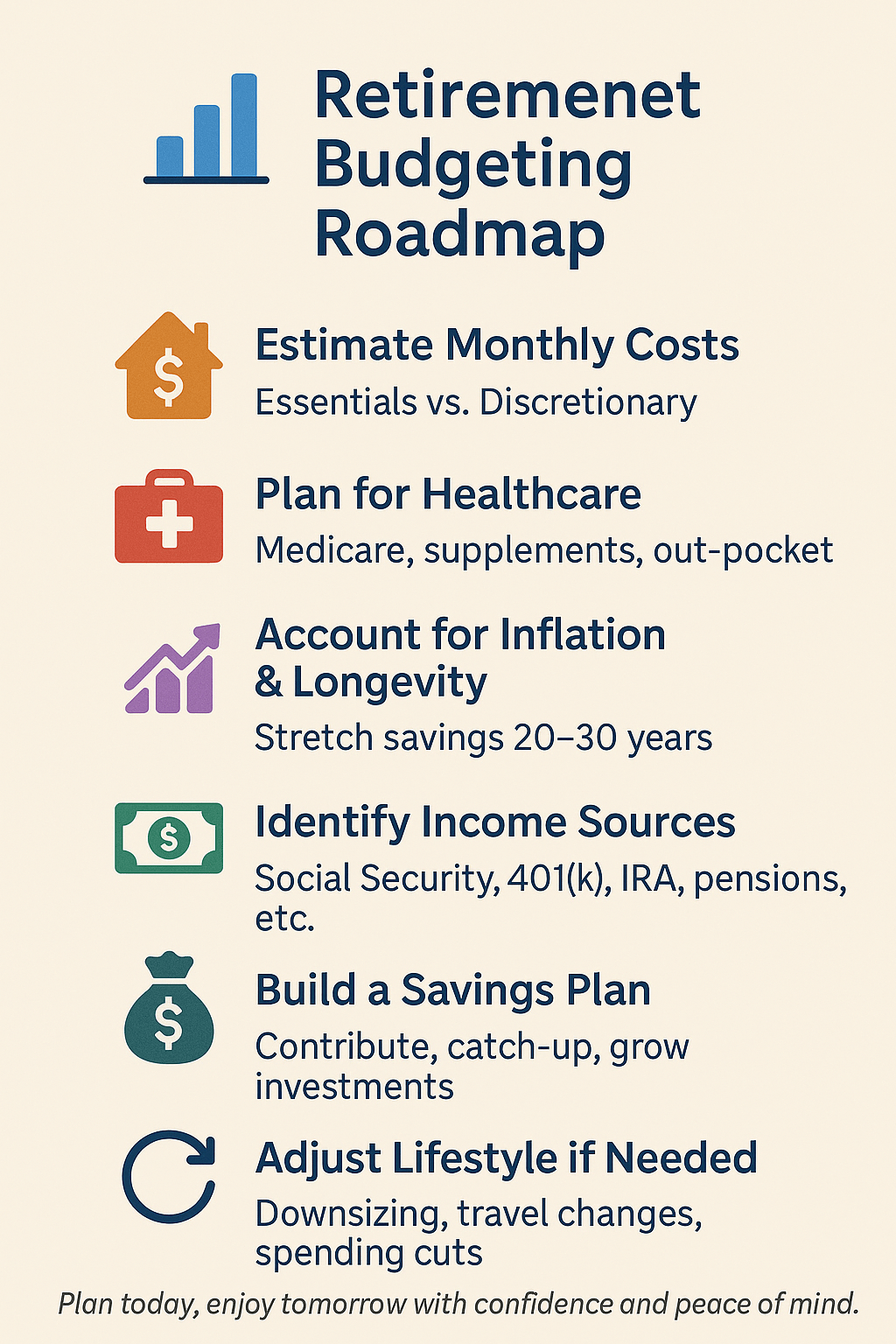

Budgeting for retirement is essential because it ensures you won’t outlive your savings. With people living longer and costs like healthcare continuing to rise, you need a clear plan to make your money last 20 to 30 years or more. A retirement budget helps you anticipate expenses, balance them against income sources like Social Security or retirement accounts, and avoid the risk of running into financial stress later in life. By knowing exactly where your money will go, you gain peace of mind and the ability to enjoy retirement without constant financial worry.

Calculate Your Expected Monthly Costs

A realistic retirement budget starts with knowing how much you’ll spend each month. Break your costs into two categories: essential expenses like housing, food, utilities, insurance, and healthcare, and discretionary expenses like travel, hobbies, and entertainment. Some costs, such as commuting or work-related expenses, may decrease in retirement, while others, especially medical care, are likely to increase. By estimating your monthly expenses ahead of time, you’ll know how much income you’ll need to maintain your lifestyle and avoid surprises down the road.

Avoid common pitfalls by reading 5 Common Budgeting Mistakes To Avoid.

Factor in Healthcare Costs

Healthcare is one of the biggest and most unpredictable expenses in retirement, making it critical to plan for. While Medicare will cover some medical costs once you’re eligible, it doesn’t pay for everything, such as dental, vision, hearing aids, or long-term care. Many retirees also choose supplemental insurance plans, which add to monthly expenses. Out-of-pocket costs like prescriptions, co-pays, and unexpected medical bills can add up quickly. By including healthcare as a dedicated line in your retirement budget, you’ll be better prepared to handle rising medical expenses without jeopardizing your financial security.

Learn exactly how in, What’s An Emergency Fund And How To Build One.

Consider Inflation and Longevity

Two factors that can significantly impact your retirement budget are inflation and how long you’ll live. Even a modest inflation rate can erode your purchasing power over a 20–30 year retirement. At the same time, people are living longer than ever, which means your savings may need to stretch for decades. Building in extra cushion for inflation and planning for a longer lifespan ensures you won’t run short of funds later in life.

Identify Your Retirement Income Sources

Once you’ve estimated your expenses, the next step is to identify all the income streams you’ll rely on. Common sources include Social Security benefits, pensions, 401(k)s, IRAs, and other retirement accounts. You may also have investments, rental properties, or even part-time work that can supplement your income. Knowing exactly what money will be coming in each month helps you match it against your expenses and identify any gaps you need to fill.

Build a Retirement Savings Plan

If your projected income won’t fully cover your expected expenses, it’s time to strengthen your savings strategy. Maximize contributions to retirement accounts while you’re still working, and take advantage of catch-up contributions once you reach age 50. Consistency is key, small, steady contributions add up significantly over time. The goal is to ensure your savings grow enough to cover both your essential costs and the lifestyle you want in retirement.

Adjust Your Lifestyle if Necessary

Sometimes, closing the gap between retirement income and expenses means making adjustments. This could include downsizing your home, reducing discretionary spending, or prioritizing needs over wants. Even small lifestyle shifts, like traveling less frequently or cutting luxury expenses, can make a big difference in extending your savings. By making thoughtful choices, you can maintain financial security without feeling deprived.

For more ideas, read How To Budget On a Low Income: Practical Tips That Work.

Summary

Budgeting for retirement is about balancing today’s planning with tomorrow’s security. By estimating your expenses, factoring in healthcare and inflation, and aligning them with reliable income sources, you create a realistic roadmap for your retirement years. Building a strong savings plan and being willing to adjust your lifestyle as needed ensures your money lasts as long as you do. With preparation and consistency, you can enjoy retirement with confidence, freedom, and peace of mind.

FAQs

How much should I assume for inflation when planning retirement?

A common rule of thumb is 2–3% per year, but healthcare and housing often rise faster. It’s safer to plan on slightly higher inflation for essential costs.

What if I outlive my savings?

Planning for longevity is key. Strategies include annuities that guarantee lifetime income, delaying Social Security to maximize benefits, and keeping part of your portfolio in growth investments to outpace inflation.

How can I make my retirement income more reliable?

Diversify across multiple sources, Social Security, pensions, retirement accounts, and conservative investments. Some retirees also use bond ladders or annuities to create predictable monthly income.

Is it too late to save more if I’m close to retirement?

Not at all. Take advantage of catch-up contributions after age 50, reduce unnecessary spending, and consider part-time work to give your savings more breathing room. Even a few extra years of saving can make a meaningful difference.

Should I keep investing after I retire?

Yes, but with a balanced approach. Keeping part of your portfolio in stocks or growth-oriented funds helps your money last longer, while bonds and cash provide stability and income. The exact mix depends on your risk tolerance and goals.

What lifestyle adjustments make the biggest impact in retirement?

Downsizing your home, cutting transportation costs, reducing luxury spending, and relocating to lower-cost areas can all stretch your savings significantly while maintaining quality of life.